Homeowners Insurance in and around Glen Ellyn

If walls could talk, Glen Ellyn, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

It's so good to be home, especially when your home is insured by State Farm. You never have to be uneasy about the unanticipated with this outstanding insurance.

If walls could talk, Glen Ellyn, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

Why Homeowners In Glen Ellyn Choose State Farm

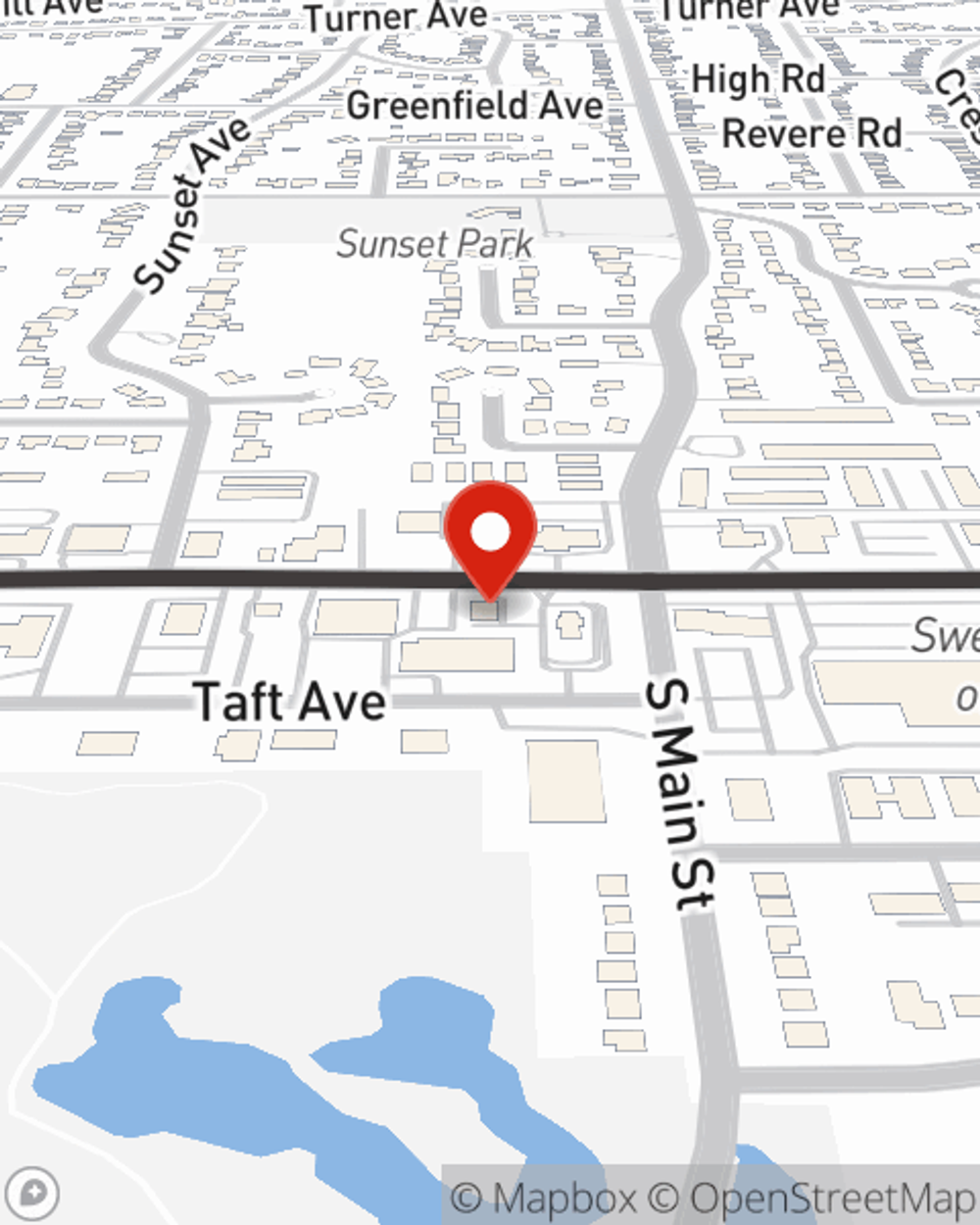

Handling mishaps is made easy with State Farm. Here you can personalize your policy or submit a claim with the help of agent Chris Cravatta. Chris Cravatta will make sure you get the personalized, high-quality care that you and your home needs.

Now that you're convinced that State Farm homeowners insurance is right for you, visit Chris Cravatta today to explore your particular options!

Have More Questions About Homeowners Insurance?

Call Chris at (630) 620-1999 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Home inspection: What's included and not?

Home inspection: What's included and not?

Consider a professional home inspection to help identify any immediate or potential issues before signing the papers on a new house.

Strategies to save for a house

Strategies to save for a house

Saving for a house means figuring out how to save money for a down payment. Use these helpful steps to get started.

Chris Cravatta

State Farm® Insurance AgentSimple Insights®

Home inspection: What's included and not?

Home inspection: What's included and not?

Consider a professional home inspection to help identify any immediate or potential issues before signing the papers on a new house.

Strategies to save for a house

Strategies to save for a house

Saving for a house means figuring out how to save money for a down payment. Use these helpful steps to get started.